Content

- Purchase Guidelines

- Examples of Reserve for encumbrances in a sentence

- Download a free copy of “Preparing Your AP Department For The Future”, to learn:

- Demand Forecasting Methods: Choosing The Right Type For Your Business

- . 14. To close the Reserve for Encumbrances account at the end of…

- ENCUMBRANCES – 8340

- Types of Encumbrances

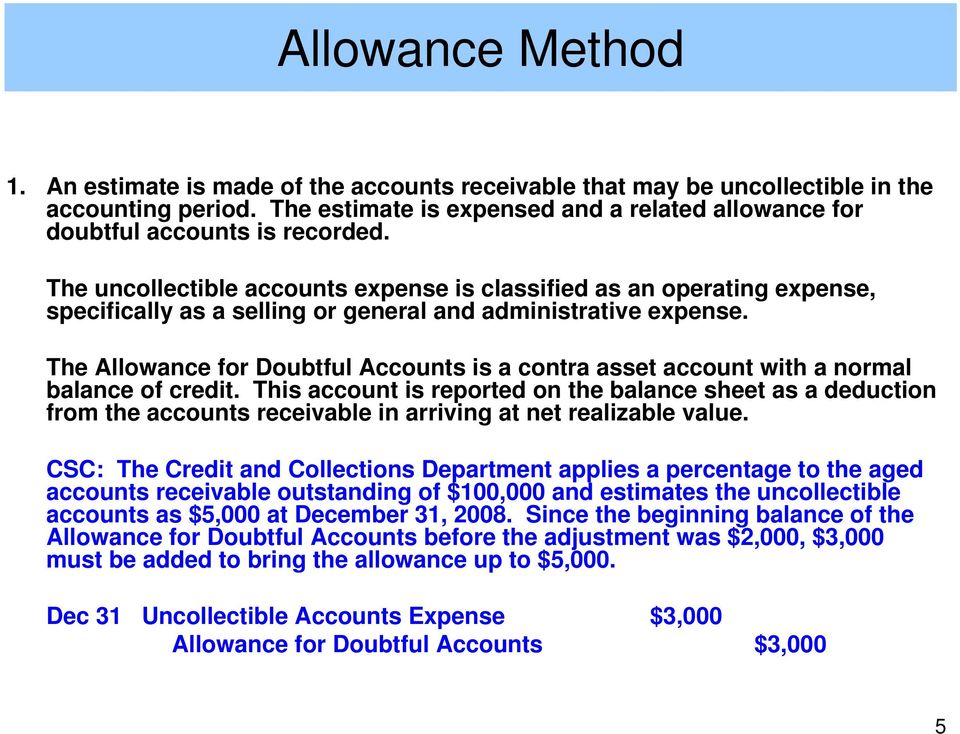

This is done before creating and collecting the underlying documents, such as purchase requisitions and purchase orders. Reserve for encumbrancesmeans a re- serve representing the segregation of a portion of a fund balance to provide for unliquidated encum- brances. Obligation – When a requisition is converted to a purchase order and the order is approved then commitment is replaced by an obligation.

Those accounts are standing program accounts and exclude projects, utilities, benefits, and reserves. These carry-forwards will be processed on or about October 16, after final balances are obtained from the General Accounting Office. Texas State, like most universities, uses fund accounting to properly account for all financial resources received and used. Fund accounting classifies all resources into funds according reserve for encumbrances to specific limitations placed on their use by the resource providers. Special revenue funds are used when it is desirable to provide separate reporting of resources that are restricted or committed as to expenditure for purposes other than debt service or capital projects. Encumbrances, which is debited with the estimated cost of purchased orders placed and credited when the goods/services are received.

Purchase Guidelines

Debit reserve for encumbrance and credit encumbrances. An order was placed for goods or services estimated to cost $15,000; the actual cost was $15,350 for which a liability was acknowledged upon receipt. Pre-encumbrance requests ask management to set up an encumbrance. If for example, the IT department seeks to purchase $30,000 in new computer equipment, someone in the department will make a pre-encumbrance request to approve the purchase.

Invested in capital assets, net of related debt represents the net amount invested in capital assets (original cost, net of accumulated depreciation, and capital-related debt). City would follow budgetary basis in preparation for its annual operating budget. Barbara is currently a financial writer working with successful B2B businesses, including SaaS companies. She is a former CFO for fast-growing tech companies and has Deloitte audit experience. Barbara has an MBA degree from The University of Texas and an active CPA license.

Examples of Reserve for encumbrances in a sentence

The encumbrance accounting rules may be used to record adjustments and make corrections to the encumbrance accounts and the reserve for encumbrance accounts. Encumbrance transactions are entered through the Budgetary Control module using the encumbrance adjustment screens. Encumbrances are treated as expenditures under the state’s budgetary basis of accounting and reported as such in the agency’s/department’s year-end financial reports and in the Governor’s Budget for most governmental cost funds. Encumbrances and expenditures in the agencies/departments year-end financial reports must be accounted the way they were budgeted.

The certificate of funds availability must be signed by the agency’s/department’s designated approver after ensuring that funds are available. Any required control agency approvals are retroactive to that date. However, agencies/departments must meet the deadlines for submitting procurement documents as specified by the DGS.

Download a free copy of “Preparing Your AP Department For The Future”, to learn:

Expenditures are controlled at the fund level for all budgeted departments within the City. This is the level at which expenditures may not legally exceed appropriations. For Purchase Order and Travel Authorization encumbrances, when the vendor or employee is paid, part or all of the encumbrance is released in accordance with that payment. The department will see a transaction that will appear under their Actuals , separate from their Encumbrance (EX/IE/CE) debit/credit transactions.

Pre encumbrance is a commitment to pay in the future for the goods or services that are ordered but not yet received. It reserves the money for your future payments so the money cannot be used for any other activities than what it is intended for. The amount of money reserved is called Encumbrance.

In the context of financial reporting, the term fund balance is used to describe the net position of governmental funds calculated in accordance with generally accepted accounting principles . Within governmental funds, equity is reported as fund balance; proprietary and fiduciary fund equity is reported as net assets. Fund balance and net assets are the difference between fund assets and liabilities reflected on the balance sheet or statement of net assets. Because of the current financial resources measurement focus of governmental funds, fund balance is often considered a measure of available expendable financial resources. This is a particularly important measure in the general fund because it reflects the primary functions of the government and includes both state aid and local tax revenues.

- The City of Denton uses encumbrance accounting to control expenditures.

- An application under Electronic Money regulations 2011 has been submitted and is in process.

- Capital budgets focus on plans for the acquisition and construction of fixed assets.

- At year-end Oakland County had $3,000 in outstanding purchase commitments on the books.

The amount and nature of the reservation of fund balance should be disclosed on the face of the financial statements. The description may need to be supplemented by disclosure in the notes to the financial statements. An available appropriation represents the amount of the appropriation that can still be obligated or spent within the availability period allow in the Budget Act. The available appropriation is determined by subtracting actual expenditures and outstanding commitments from the appropriated amount. The procurement process begins with the intent to purchase goods or services.

Encumbrances vs. Actual Expenses

If Hill City had $5,000 of purchase commitments outstanding at the end of Year 1 and received those goods during Year 2 at a cost of $4,900, what would be the impact on total Fund Balance for Year 2? Total Fund Balance at the end of Year 2 would be $4,900 less than at the end of Year 1. Total Fund Balance at the end of Year 2 would be $100 less than at the end of Year 1. Total Fund Balance at the end of Year 2 would be $100 greater than at the end of Year 1. An encumbrance is a reserve of funds set aside for a particular purchase.

Is reserve for encumbrances the same as encumbrances outstanding?

Reserve for encumbrances represents encumbrances outstanding at the end of the year based on purchase orders and contracts uncompleted as of the close of the fiscal year.

What does encumbrance mean in budget?

Encumbrances are also known as pre-expenditures since they act as budgeted reserve funds before the actual expenditure. While appropriations are money set aside for budgetary line items, encumbrances are reserves for a specific item. Some examples of encumbrances are utility payments, tax payments, and payroll.